India Form No.16 2010 free printable template

Show details

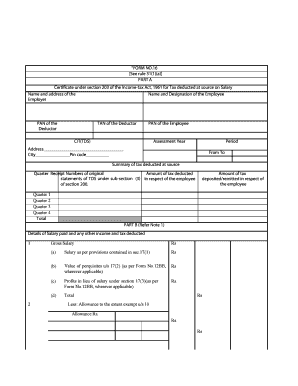

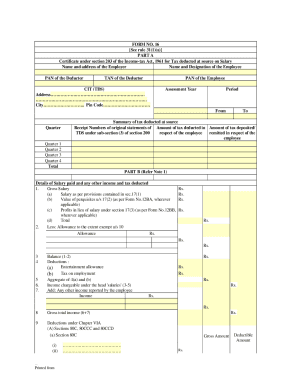

FORM NO. 16 See rule 31(1)(a) PART A Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source on Salary Name and address of the Employer Name and Designation of the Employee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign India Form No16

Edit your India Form No16 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India Form No16 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit India Form No16 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit India Form No16. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India Form No.16 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out India Form No16

How to fill out India Form No.16

01

Collect the necessary personal information like name, address, and PAN.

02

Gather details of income earned during the financial year.

03

Compile the tax deduction details, including TDS amounts from different sources.

04

Fill in the applicable sections of the form based on the income sources and deductions.

05

Ensure to mention any tax exemptions or deductions claimed under sections like 80C, 80D, etc.

06

Review all the information for accuracy.

07

Sign and date the form before submission.

Who needs India Form No.16?

01

Employees receiving a salary from their employers.

02

Freelancers or professionals who have had tax deducted at source.

03

Individuals who have applied for loans or need to file income tax returns.

04

Anyone who requires proof of income and tax payments for financial transactions.

Fill

form

: Try Risk Free

What is form no 16?

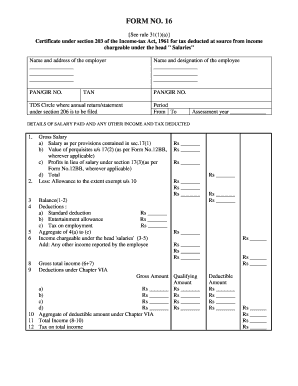

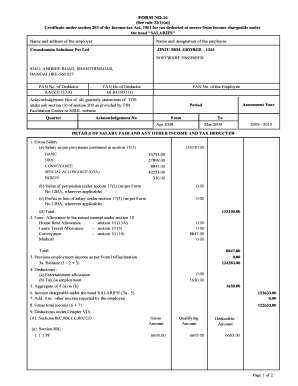

Form 16 is the certificate issued under section 203 of the Income tax Act for tax deducted at source (TDS) from income under the head 'salary'. It is issued on deduction of tax by the employer from an employee's salary and deposit of the same with the government. ... The form has to two parts: Part A and Part B.

People Also Ask about

How to prepare Form 16 in Excel?

Select the options as provided before generation. Select the rows that you wish to generate Form 16 Part B. Click on "Generate Form 16" button to generate the Form 16.

Can I download my TDS certificate?

To download the TDS certificate you need to visit the TRACES web portal. TRACES is the online platform created to help users with TDS returns, corrections of TDS Returns, downloading TDS documents.

What is the TDS certificate?

TDS or Tax Deduction at Source refers to a tax collection methodology under income tax law. Any person who is required to deduct tax at source and has deducted TDS must issue a TDS certificate. TDS certificate helps the assessee to claim the applicable tax credit, along with the applicable refunds.

How can I get TDS certificate?

How to get a TDS certificate online? The deductor must log into the TDS Reconciliation Analysis and Correction Enabling System (TRACES) by clicking here. Here, they have to go to the 'downloads' tab. Next, they can select the Form the deductor wishes to download (Form 16/16A).

How to generate a TDS certificate?

How to get a TDS certificate online? The deductor must log into the TDS Reconciliation Analysis and Correction Enabling System (TRACES) by clicking here. Here, they have to go to the 'downloads' tab. Next, they can select the Form the deductor wishes to download (Form 16/16A).

How do I claim my TDS refund?

How to claim TDS Refund Online After registration, you can file your income tax return by downloading the relevant ITR form. Fill in the requisite details, upload the Form and click on submit. Upon filing the ITR, an acknowledgement is generated for the ITR submitted, which you must e-verify.

How to generate Form 16 PDF?

Extract the zip file and open JAR file. Follow the steps to download pdf of Form 16A Select zip file of Form 16A. Enter your TAN as the password for the input file. Select the folder to save the output pdf file. Select digital certificate to digitally sign the PDF files – this is not mandatory.

How to file ITR with Form 16?

How to File ITR With Form 16? Step 1: Visit the Income Tax e-Filing portal. Step 2: Select the applicable ITR utility under 'Downloads'. Step 3: Fill in the required details on the ITR form. Step 4: Validate all tabs and calculate tax. Step 5: Generate information into an XML sheet.

How do I submit Form 16A?

How to Fill Form 16A Online? Start this process by downloading the Form 16A first. Enter a deductor's name and address. Fill in a deductor's TAN and PAN details. Enter basic details such as contractual type, nature of payments, details of the profession, etc. Also, enter the four acknowledged numbers.

How to claim TDS Form 16A?

Step-by-step Procedure to Download Form-16A Step 1: Login to TRACES. To login on TRACES, enter your User Id, Password, TAN or PAN and the captcha code. Step 2: Select Form 16A. Step 3: Select Financial Year and PAN. Step 4: Details of authorised person. Step 5: KYC validation. Step 6: Success Message.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit India Form No16 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your India Form No16 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I fill out India Form No16 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your India Form No16 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I complete India Form No16 on an Android device?

Use the pdfFiller mobile app to complete your India Form No16 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is India Form No.16?

India Form No. 16 is a certificate issued by an employer to an employee that provides details about the salary paid and the tax deducted at source (TDS) during the financial year.

Who is required to file India Form No.16?

Employers who are required to deduct tax at source (TDS) on the salary paid to their employees must issue Form No. 16 to those employees.

How to fill out India Form No.16?

To fill out Form No. 16, employers must include the employee's details such as PAN, details of salary paid, TDS deducted, and any exemptions claimed, along with other necessary information as per the Income Tax rules.

What is the purpose of India Form No.16?

The purpose of Form No. 16 is to serve as proof of the income earned by the employee and the tax deducted thereon, which can be used for filing income tax returns.

What information must be reported on India Form No.16?

Form No. 16 must report information including the employee's name, PAN, address, the employer's details, total salary paid, TDS deducted, and specifics about any deductions claimed under sections such as 80C, 80D, among others.

Fill out your India Form No16 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India Form no16 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.